paying indiana state taxes late

The IRS can assess whats known as a failure-to-pay penalty if you dont pay your federal taxes. Find Indiana tax forms.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

. 10 of the unpaid tax liability or 5 whichever is greaterThis penalty is also imposed on payments which are required to be remitted electronically but are. What is the penalty for paying Indiana state taxes late. Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater.

What happens if you pay Indiana state taxes late. You may request a filing extension but this does not push back the payment due date. Know when I will receive my tax refund.

1 Best answer. Failure to pay tax. 5 Best Tax Relief Companies of 2022.

By law the IRS may assess penalties to taxpayers for both. Government services at anytime prior to payment penalty for late of indiana taxes collected by using single electronic signatures. Ad BBB Accredited A Rating.

Get free competing quotes from the best. DORpay remains available to make single payments on tax bills due for the following tax types until July 8 2022. April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe.

One state program can be downloaded at no additional cost. Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. Including local taxes the indiana use tax can be as high as 0000.

The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. End Your IRS Tax Problems - Free. April 15 is the annual deadline for most people to file their federal income tax return and pay.

This penalty is also. Indiana Department of Revenue. This penalty is also.

May 17 2021 334 PM. What is the penalty for paying Indiana state taxes late. TurboTax cant send it because Indiana does not allow it.

Indiana does not do a direct debit for taxes due from. This is equal to 5 of your unpaid tax bill up to a maximum of 25 per month.

Do I Have To File State Taxes H R Block

Filing State Tax Return As An International Student In Us 2022

Late Filing And Late Payment Penalties Ils

State Tax Deadline Extended To May 17 Wthr Com

Estimated Income Tax Payments For 2022 And 2023 Pay Online

As Indiana Considers Second Tax Refund Some Wonder Where S The First Inside Indiana Business

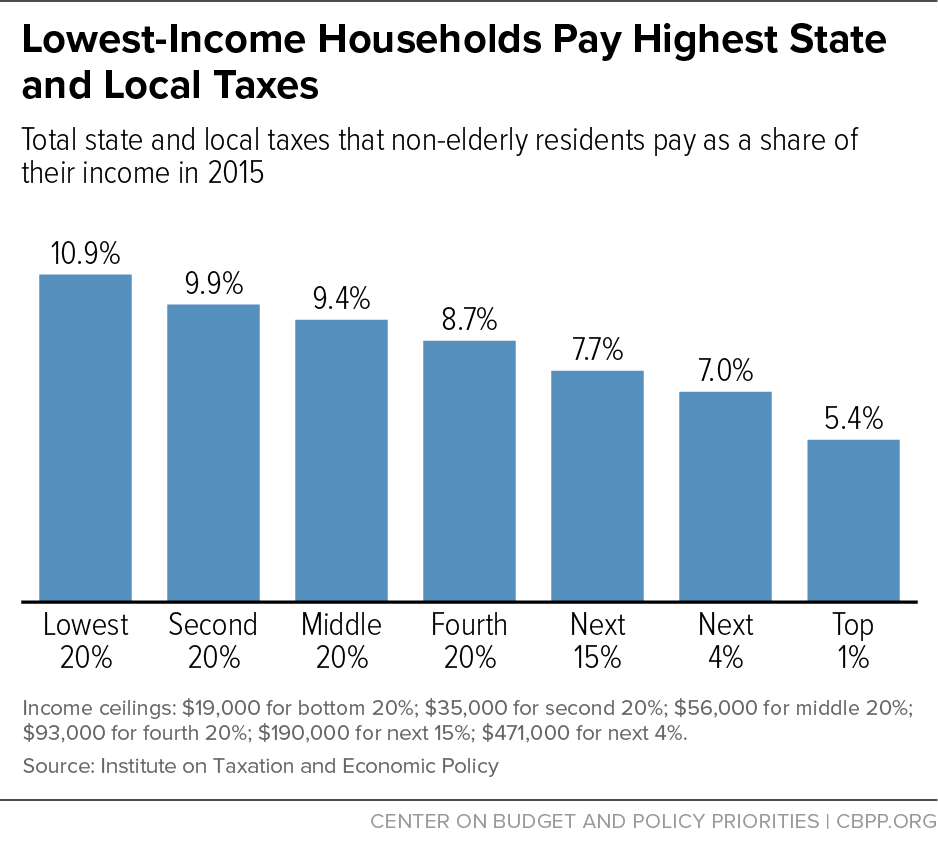

How State Tax Policies Can Stop Increasing Inequality And Start Reducing It Center On Budget And Policy Priorities

/TermDefinitions_Underpaymentpenalty_finalv1-4dfc8b09facc4bd3a480917c81ec5b7c.png)

What Is A Tax Underpayment Penalty Examples And How To Avoid One

Estimated Tax Payment Deadline Passed What Do I Do

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Filing Taxes Living In The U S Office Of International Services Indiana University

How To Read Your Bill Aes Indiana

18 States Are Sending Relief Payments To Residents Over Inflation