kern county property tax payment

On-line payment Instructions. Start by looking up your property or refer to your tax statement.

Kern Leaders Outline Need For Sales Tax News Taftmidwaydriller Com

1115 Truxtun Avenue Bakersfield CA 93301-4639.

. Please enable cookies for this site. The first installment is due on 1st. Kern County Property Tax Payments Annual Kern County California.

This law requires that any increase or. Kern County real property taxes are due by 5 pm. Business Personal Property.

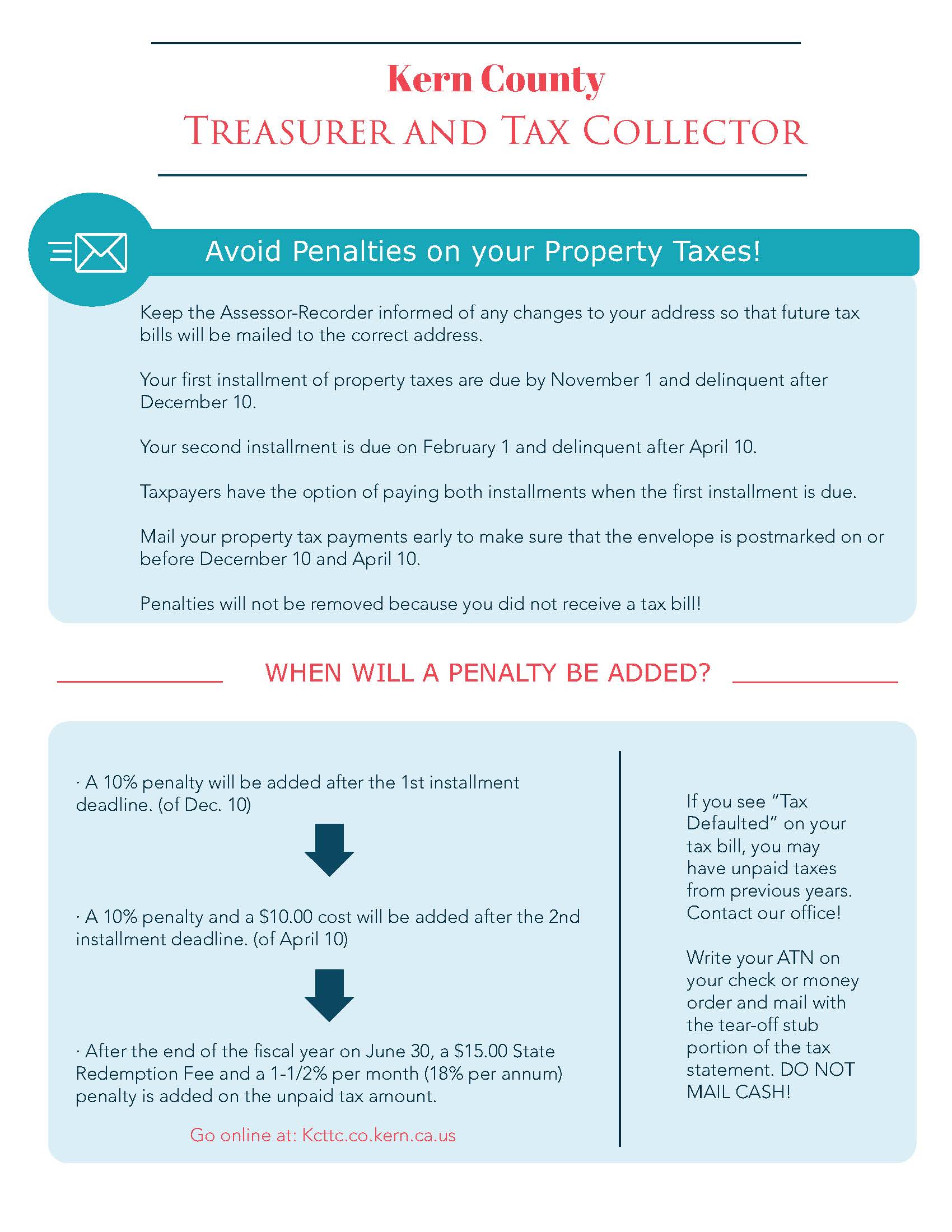

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. If you own property in Kern County and did not receive your tax bills contact the County Treasurer-Tax Collectors Office. Auditor - Controller - County Clerk.

To avoid a 10. Median Property Taxes No. 800 AM - 500 PM Mon-Fri 661-868-3599.

In Kern County California a home worth 217100 pays a median property tax of 1746 per year. Please access our website for additional information. The owner search is the.

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. To make monthly payment arrangement for delinquent case s To consolidate New and delinquent case payments into one monthly payment plan. 1115 Truxtun Avenue Bakersfield CA 93301-4639.

Search for your property. Senate Bill 813 enacted on July 1 1983 amended the California Revenue and Taxation Code to create what are known as Supplemental Assessments. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector.

Please select your browser below to view instructions. Look up your property here 2. Kern County CA Home Menu.

Property Taxes - Pay Online. This means that residents can expect to pay about. The first installment is due on 1st.

Exclusions Exemptions Property Tax Relief. Residents of Kern County pay an average of approximately 283 of their. Cookies need to be enabled to alert you of status changes on this website.

In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average. Secured tax bills are paid in two installments. Supplemental Assessments Supplemental Tax Bills.

800 AM - 500 PM Mon-Fri 661-868-3599. Real Property Tax Real Estate 206-263-2890. Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email.

See below links. Auditor - Controller - County Clerk. Secured tax bills are paid in two installments.

Median Property Taxes Mortgage 2286.

Fire Facts Kern County Firefighters

Kern County Treasurer And Tax Collector

Kern County California Genealogy Familysearch

Kern County Treasurer And Tax Collector

Medi Cal Kern County Ca Department Of Human Services

Kern County Firefighters Iaff Local 1301 Home Facebook

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

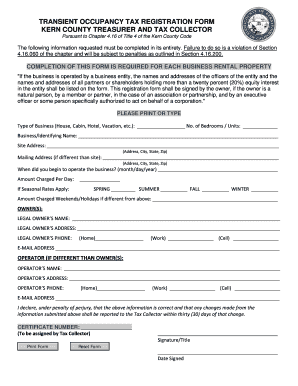

Fillable Online Kcttc Co Kern Ca Business Registration Form Kern County Treasurer And Tax Collector Kcttc Co Kern Ca Fax Email Print Pdffiller

Kern County Probation Monthly Report Fill Out Sign Online Dochub

Kern County Treasurer And Tax Collector

Kern County Ca Tax Rate Areas Gis Map Data Kern County California Koordinates

Kern County Ca Property Tax Search And Records Propertyshark

Property Tax Portal Kern County Ca

County Of Kern On Twitter Kern County Treasurer And Tax Collector Jourdan Kaufman Recently Announced The Extension Of The Property Tax Deadline From April 10th 2020 To May 4th 2020 Https T Co Ajxspn38xm

Kern County Treasurer And Tax Collector

Sell My House Fast Kern County Ca We Buy Houses For Cash Sell My House Fast California We Buy Houses For Cash

Kern County Board Of Supervisors Approve 2022 2023 Fiscal Budget Kbak

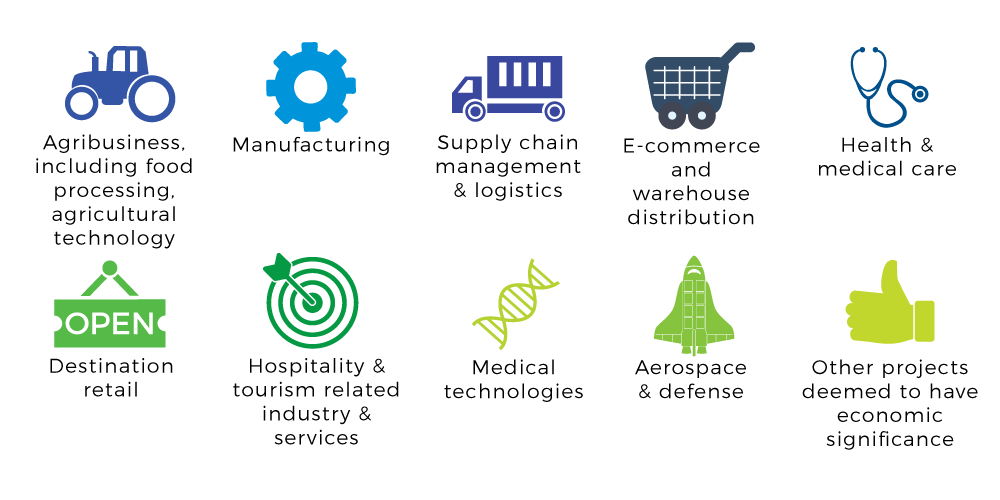

Advancekern Kern County Business Recruitment Job Growth Incentive Initiative